Narratives Dictate

Like any other cycle, this cycle has trending narratives like AI, DePIN, and RWA. Many of these sectors have tremendous futures. However, they are outmatched by tokenization and RWA. This may appear contrary to what I recently wrote regarding DePIN. However, I addressed the potential of income generation for the average person and how DePIN was and is the best sector to achieve this outcome.

In other words, profiting from tokenization and real-world assets will require investment capital. It is impossible to gain exposure without deploying capital. DePIN, on the other hand, can generate passive income by turning your devices into nodes. As I mentioned, receiving $600 worth of GRASS tokens for downloading a browser extension is effortless and passive.

Sure, I had the help of a few referrals. However, it’s an ongoing avenue of income that will continue to grow. Ongoing earnings from the Grass application and staking rewards achieve this. Essentially, DePIN applications have the power to produce investment capital for alternative assets if so desired. So, yes, DePIN is better positioned than any sector when you view it in this context.

Not Just A Narrative

DePIN will experience monstrous growth, and AI will be infused into many sectors and aspects of everyday life. However, tokenization, which incorporates real-world assets by default, is more than a narrative. It has been said for many years that we are in a digital age. This is true to a point. However, tokenization is the final and all-encompassing transition to complete digitization.

When all real-world assets are on-chain, and ownership is proven and transferred via blockchains and blockchain protocols, it will no longer be a trend or a “sector” but common practice. Anything that becomes standard practice experiences the most expansion and appreciation. This is very difficult for some to envision. These are likely the same individuals who said Cryptocurrency is a fad and has no real value or relevance.

Well, hindsight has proven them incorrect. Now, governments are even holding institutional-grade assets, some smarter than others. Germany has to be noted as being out of touch and irrelevant regarding its recent decision to sell its Bitcoin holdings at the most foolish time. This is not merely stated in hindsight. Anyone understanding the Crypto cycles and the broader picture can attest to this.

Accepting Bitcoin and Crypto as a valuable asset class is the non-negotiable and foundational requirement for a move to tokenization. You cannot build on land you believe to be questionable or unstable. Enormous trust needs to be established, and those who embrace, adopt, and subsequently prove it to be such will lead the shift to tokenization. One of the reasons I started Sapphire Crypto was to go on record.

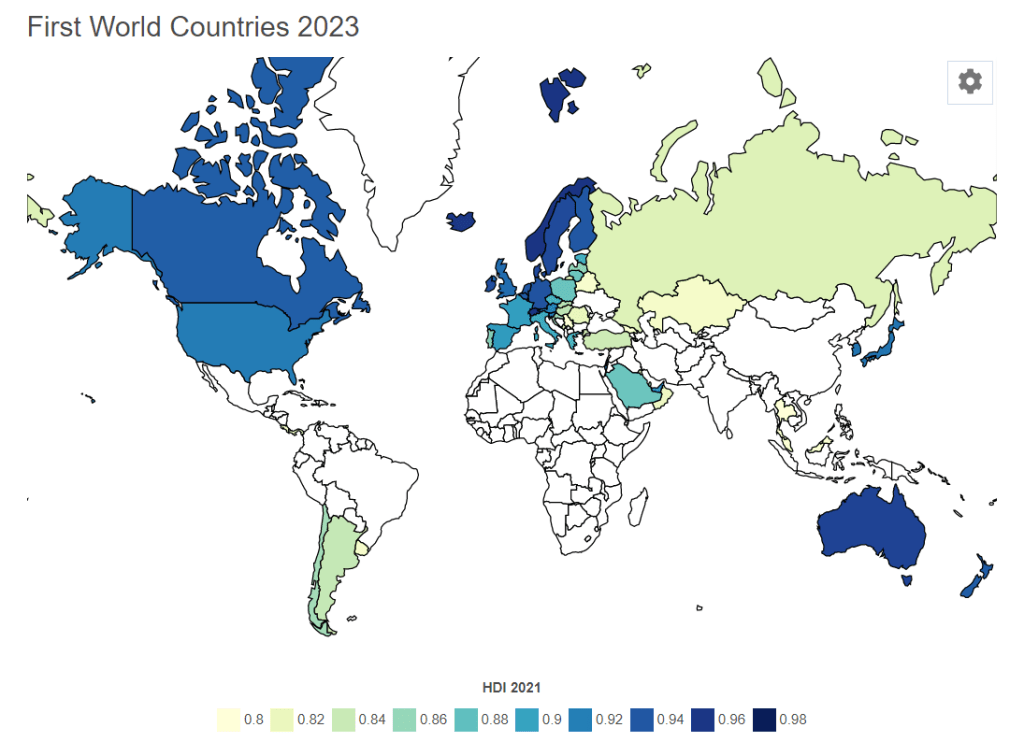

Years ago, I stated that First World countries would begin to lose their dominance and appeal. This is depicted in an article from early 2023 entitled The Reshaping Of Global Stratification & The Role Of Crypto. The following is an excerpt from the article:

Looking at many First World countries gives one the impression that they are actually in a state of reversion. Once sophisticated nations are going backward in multiple areas, it is inherently critical to stability and advancement. One must also remember that individuals and families take their wealth with them when they leave these jurisdictions. This is likely to be invested in real estate once they arrive at their destination of choice.

Many empires of the ancient past are now not only irrelevant but avoided like a plague. Nobody is interested in living there or building anything of value there. History has a way of reshuffling the pieces on the board. Dominance today is not guaranteed tomorrow, and a stubborn persistence regarding laws and policies is like taking a sledgehammer to a well-built and beautiful building.

Embracing Innovation

Countries that embrace innovation and, eventually, tokenization will have the opportunity to move ahead of those who don’t. As mentioned in The Reshaping Of Global Stratification & The Role Of Crypto, once there is mass migration and associated wealth, the result is an improvement. This is often first seen in the real estate market. Other areas of the economy begin to respond once a critical mass is achieved.

Tokenization will invade every form of ownership; it’s a matter of time. You can disagree, but opinions don’t matter. When I predicted the banking collapse of 2023 in 2022, many considered it an unlikely event, some perhaps even an impossibility. However, not only was the banking collapse predicted, but it was also a strong move for Bitcoin. Subsequently, Bitcoin rallied 44% in a matter of 2 weeks.

It’s important to remember that the market was still suppressed in early 2023, and a 44% move from Bitcoin was unexpected. Once a path is plotted, the outcome is inevitable. You cannot head West and expect to arrive at a destination North. Such simple logic seems to evade many in power today. This is another catalyst for tokenization, the removal of human processing, and the many associated errors and delays.

Tokenized real estate can be bought and sold within 24 hours. A process usually takes weeks and months and can be performed multiple times daily. Advantageous technological advancements have a way of replacing the procedures of the past. Tokenization will not only have a far-reaching effect, it will revolutionize ownership.

Final Thoughts

RWA should be part of every portfolio, not only Crypto portfolios. It’s the one sector guaranteed to boom and offers a decent window period. What do I mean by this? It won’t simply be a narrative for this cycle. Tokenization will continue to experience enormous growth almost indefinitely. I have often said that I expect RWA to heat up during the final stages of the current bull market.

Not only that, but I envision it coming into its own around 2030. It is only much later that tokenization will begin to enter its full potential, creating an unparalleled opportunity for accumulation. Many will miss this move because they are too short-term focused. However, tokenization is undoubtedly one of the most significant opportunities of the decade. All the best, and I will see you next time!