Decentralization Remains The Objective

Cryptocurrency was created with decentralization in mind. This has remained a key dynamic regarding Crypto. Decentralization is always used as a selling point for Crypto projects. It carries weight within the Crypto community. Many OG Crypto investors invest in projects that hold to the principles of decentralization. As I have mentioned, true decentralization is a myth.

There are only levels of decentralization. Levels of purity regarding the various dynamics that act as pillars within the structure of decentralized entities. There will always be centralized entities within decentralized entities. These are usually whale alliances and partnerships of mutual benefit. This will always be the case as it is impossible to restrict such behavior within a decentralized network.

For starters, it violates the concept of decentralization, whether good or bad. This needs to be understood and then accepted. Discerning a project’s level of decentralization is a key aspect for many Crypto investors, especially long-term investors. Centralization within a particular blockchain can dictate the future decisions of that project. Confident investors want to see the broader community being in control.

Introducing The Nakamoto Coefficient

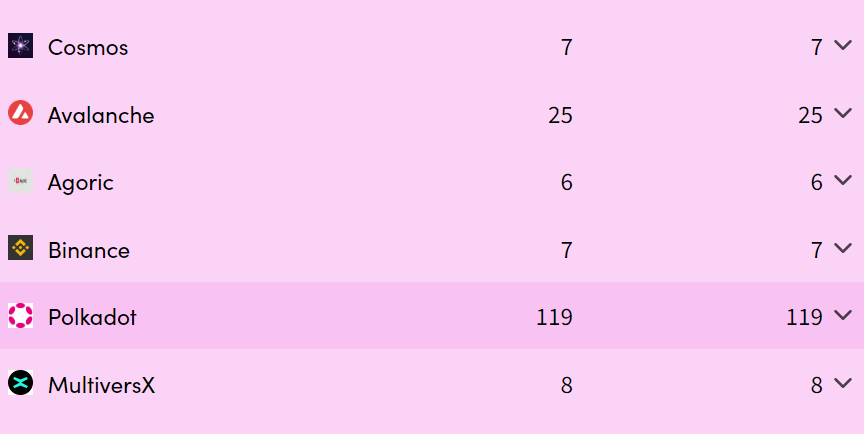

I have mentioned the Nakamoto Coefficient in previous articles. The Nakamoto coefficient measures decentralization and represents the minimum number of nodes required to disrupt the blockchain’s network. The higher the Nakamoto Coefficient, the higher the level of decentralization. Many single-digit NC Proof-of-Stake projects are in the Top 20 Crypto assets by market capitalization.

However, there are also projects within the Top 20 like Polkadot, which has an NC of 119. BNB’s centralization has always been a concern, and this can be seen in its NC score of 7, which is incredibly low, especially for such a well-established project. This is another reason I am bullish on Polkadot in the long term. It is more decentralized than its peers and is primarily focused on WEB3.

Like any indicator, the Nakamoto Coefficient is imperfect and can be manipulated. For instance, multiple nodes are secretly run by a single party. However, it does provide an overall and relatively objective analysis regarding the level of decentralization within the network. All forms of on-chain data can be manipulated to some degree, some more than others. It’s important to note that on-chain analysis is not an absolute.

There are no absolutes, especially in Finance. Manipulating data is always beneficial for someone, so it is a common practice. However, data and technical analysis remain the most effective tools in the arsenal of any successful trader or investor. There are no absolutes, no guarantees, and no promises. Financial markets are a jungle, enter at your own risk.

Final Thoughts

Utilizing the Nakamoto Coefficient will provide an element of transparency regarding a particular project’s level of decentralization. It can aid in analyzing a potential investment. Always remember that indicators should never be used in isolation. Confluence should always be the objective, which requires multiple indicators by default. All the best, enjoy your week, and I will see you at the next one!